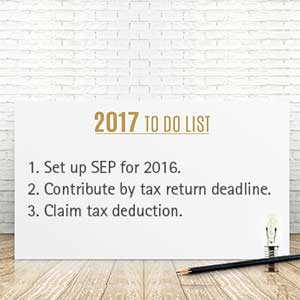

SEPs: A Powerful Retroactive Tax Planning Tool

Simplified Employee Pensions (SEPs) are sometimes regarded as the “no-brainer” first choice for high-income small-business owners who don’t currently have tax-advantaged retirement plans set up for themselves. Why? A SEP is easy to establish, unlike other types of retirement plans, and a powerful retroactive tax planning tool: The deadline for setting up a SEP is […]

What You Need to Know About the Tax Treatment of ISOs

Incentive stock options (ISOs) allow you to buy company stock in the future at a fixed price equal to or greater than the stock’s fair market value on the grant date. If the stock appreciates, you can buy shares at a price below what they’re then trading for. However, complex tax rules apply to this […]